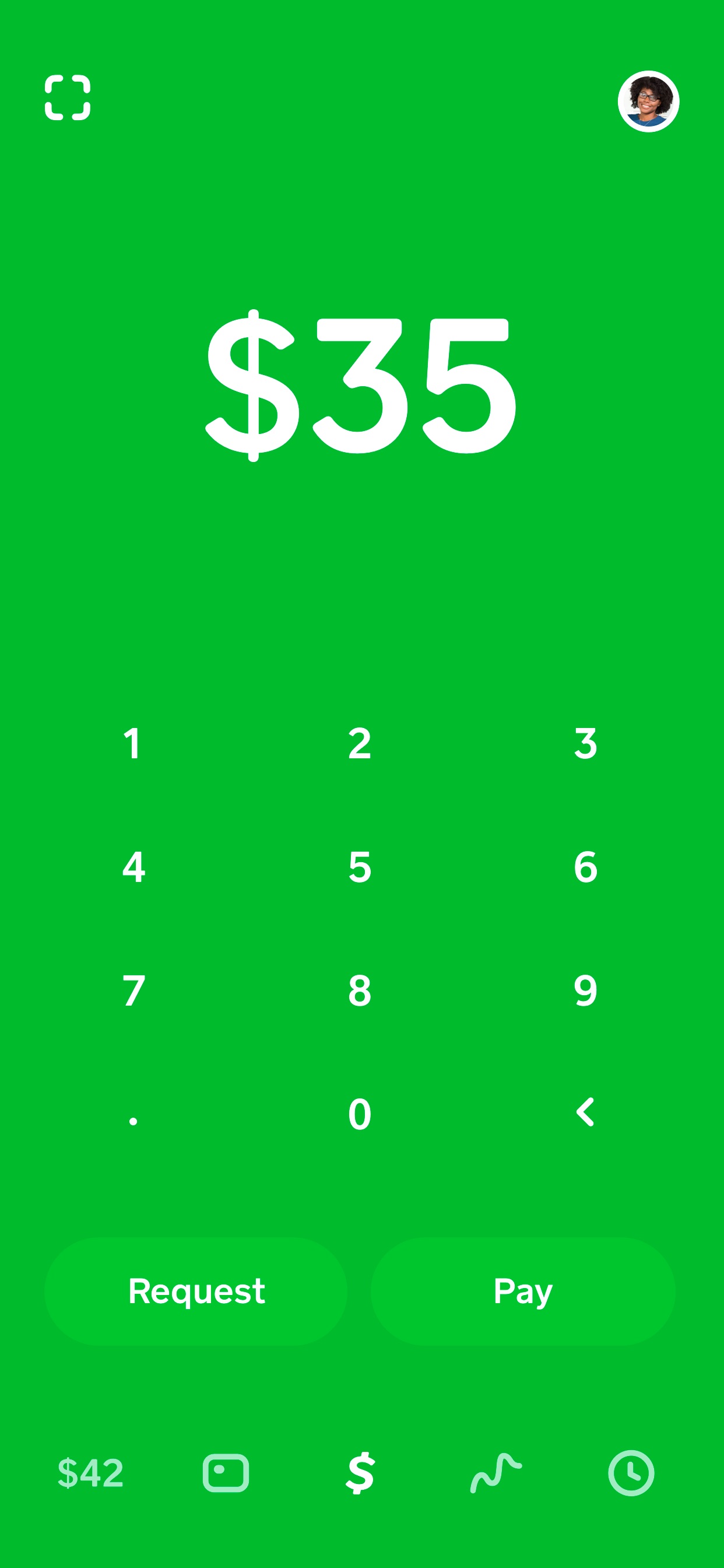

Cash App - Apps on Google Play

Unknown Facts About Protect Yourself Against CashApp Scams - Members Exchange

Chase ended up being Chase in an essentially different competitive environment, where circulation moats (i. e. branches) and high changing expenses were significant and durable benefits. Those were the days when main bank status indicated something; clients weren't going anywhere and Chase knew that, so they could hammer away at them with generic, badly pitched cross-sell deals up until the customers gave up.

Thanks to the expansion of digital account opening and the development of payroll-enabled direct deposit switching, the idea of a primary checking account has actually become much more fluid. Customers can now keep a range of checking account at the same time and immediately move funds in between them. Undoubtedly, according to research study from Cornerstone Advisors, 35% of U.S.

Cash App Review: Insane cashback, Scams, Customer Service, Hacks, Alternatives – Sly Credit

In today's competitive environment, the technological forces that have actually made it possible for Money App to compete head to head with Chase easy digital account opening, peer-to-peer network effects, low changing expenses are the very same ones that could make it possible for the next disruptive fintech business to quickly challenge them. This is the problem with innovation.

The Ultimate Guide To Square's Cash App drives nearly half of the company's Q4

Editor's note Part 2, in which I explain how financial investments in culture can supply sustainable differentiation where innovation may not, can be discovered here. Sponsored MaterialFintech Spring Meetup: Face-to-Face meetings, no masks required! No keynotes. No webinars. Simply 15-min online conferences to link with others in Fintech. Sign up with 1,000+ others for 10,000+ meetings! Qualifying Retailers & Merchants/Banks & Cooperative credit union can sign up with for complimentary! June 15-17.

Revolutapplied for a U.S. bank charter after revealing last week that it was suspending operations in Canada. Offered the obstacles that European neobanks have had broadening into The United States and Canada and Revolut's recent decision to quit on Canada, this application for a U.S. bank charter feels a bit like the couple who choose to get a pet just as their relationship actually starts to fall apart.

Charged back maliciouslyNo support from cash app: CashApp

THIS CAN WORK!"The UK's Incentivised Changing Scheme, which provided a 275 million incentive for small companies to switch from Royal Bank of Scotlandto neobanks, fell short of its target. Couple things here: 1.) As an American, I appreciate the hell out of how UK regulators manage their organization. "You make taxpayers bail you out? We're gon na pay your customers to switch to your competitors!" 2.) Even funnier though, it didn't work! The Latest Info Found Here than half of the target variety of SMEs actually switched.